High broadband strategy: Fiber optic expansion should receive financial support

Modern Internet infrastructure also needs to be guaranteed in areas where network expansion is not economically viable for operators. In response to a postulate from the Swiss National Council, the Swiss Federal Council has developed a “high broadband strategy” that calls for subsidized funding to expand fiber optic networks. This report is based on expert opinions within the industry WIK (Scientific Institute for Infrastructure and Communication Services) and presents different options to how to finance and implement the funding program.

Internet use has increased dramatically over the last 20 years. Furthermore, as digitalization spreads around the globe and the use of applications such as cloud services, artificial intelligence, and virtual reality increases, the demand for high Internet bandwidths will continue to rise.

More than 80% of Internet usage units (apartments, businesses, etc.) in Switzerland already have an Internet connection that enables speeds of at least 1 Gbit/s. However, this does not mean that speeds of 1 Gbit/s or more are possible in 80% of all buildings in general. This 80% of Internet usage units are only distributed across 48% of all buildings in Switzerland. In other words: In order to equip the remaining 20% of all Internet usage units with at least 1 Gbit/s, 52% of all buildings would need to be connected to the network.

Rural areas are at a disadvantage

Areas in which homes and businesses are not connected to a high-performance broadband network are at risk of being left behind in the wake of digitalization. This is one of the reasons why they tend to be seen as an unattractive location – both as a place to live and as a business location. These areas are dependent on the network operators expanding their grid.

But there is a problem: Network operators only expand their network where they can make a profit. Lack of profit is a common occurrence in sparsely populated areas, as fewer Internet usage units can be developed and, therefore, fewer connections can be sold. This is why the Federal Council is planning a funding program to enable network expansion in unprofitable areas to prevent a digital urban-rural divide.

The funding program in detail

The federal funding program is intended to support network expansion where private investment is demonstrably not profitable and an Internet speed of at least 1 Gbit/s is not already available. The network will be expanded using fiber optics (P2P network topology) wherever possible. Only “passive types” of infrastructure (cable ducts, fiber optics, etc.; Layer 1 in the OSI model) will be co-financed.

To ensure that private investments made by network operators are not displaced by the funding program, a market exploration procedure will be used to determine which areas are eligible for funding.

CHF 1.4 billion in funding

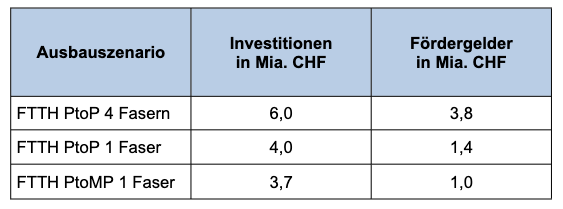

The investment required for the nationwide expansion to 1 Gbit/s depends on the expansion standard applied. According to the Federal Council, the network needs to be expanded using the P2P 1–fiber model. In contrast to the P2MP network topology, in the P2P model, each customer receives their own optical fiber from the Central Office (PoP) to their place of residence.

Compared to the P2MP 1-fiber model, an additional CHF 400 million is required for the P2P model – but this model is the only way to ensure fair competition between the providers. In its report, the Swiss Confederation also refers to the fiber optic dispute between Swisscom and Init7, as well as the related ongoing COMCO proceedings.

The 4-fiber model envisages four optical fibers running from the Central Office to each customer. This means that 4 providers will have access to the customer at the same time. With the 1-fiber model, only one provider has access to the customer, but the fiber can be switched from one provider to the other in the Central Office. Competition between providers is therefore guaranteed.

As the necessary investments and, therefore, the amount of funding required are much lower for the 1-fiber model than for the 4-fiber model, the Federal Council is in clear favor of the 1-fiber model. The additional funding of around CHF 2.4 billion required for the 4-fiber model was not justifiable.

It is still unclear as to who will pay

The Federal Council has identified various financing options for the funding program. Their focus in this regard is on payments from the ordinary federal budget and unbudgeted income from mobile communications licenses.

The rights to the mobile radio frequencies are auctioned off. The proceeds go to the Swiss Confederation. The proceeds from the last auctions in 2012 and 2019 were mainly used for debt repayment and roughly correspond to the CHF 1.4 billion required for the funding program. The next auctions will take place in 2028 and 2034. It would be possible to tie the proceeds to the funding program and thereby finance the high broadband strategy.

This solution could offer the advantage of money flowing from the telecoms sector back into the telecoms sector. However, it is uncertain how high the revenues from the licenses will be. The expansion target would therefore have to be adjusted to reflect the funds available.

If the program were financed via the budget, the Federal Government’s tight financial situation would be exacerbated, but the Federal Council believes that this option could be more widely accepted by the public because a political debate on the issue would take place.

For the sake of completion, a kind of “broadband tax”, i.e., a kind of solidarity contribution from fiber optic customers, was also considered, but was immediately rejected because it would be difficult to implement politically. However, the revenue to be generated would also be far too small to achieve the financing requirement of CHF 1.4 billion within a reasonable period of time. If the approximately 1.5 million existing FTTH subscriptions were charged a two-franc “fiber optic solidarity” fee for seven years, this would only amount to around CHF 250 million. In addition, the cantons and municipalities concerned could also conceivably contribute towards the financing process.

Funding models

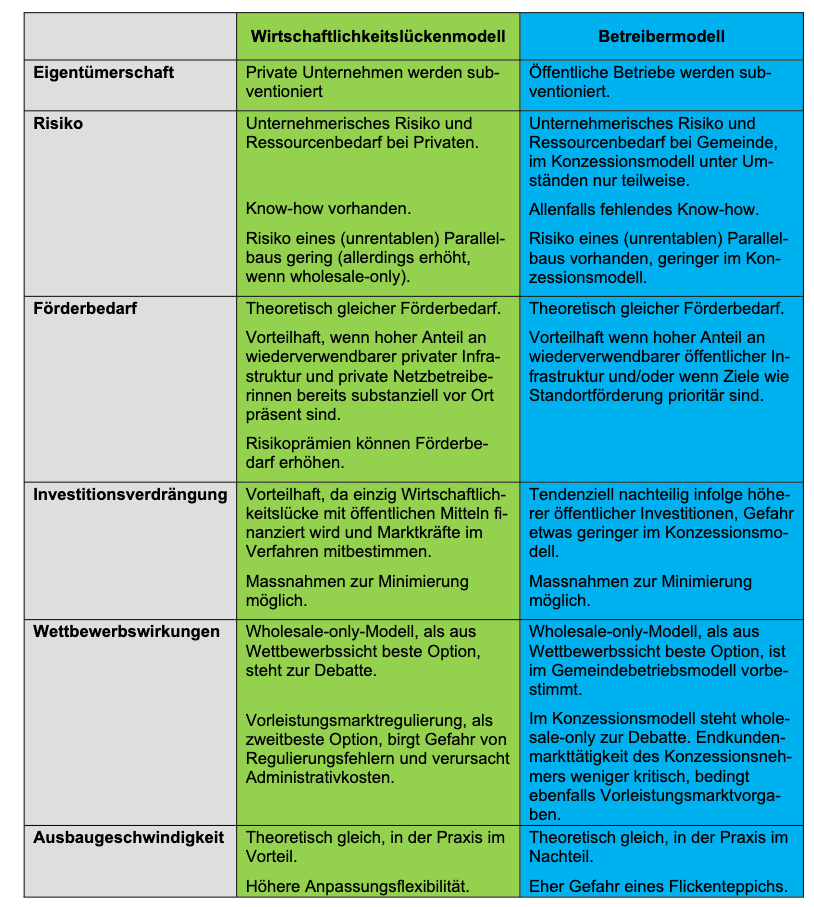

In principle, two different funding models can be considered for designing the funding program: The profitability gap model and the operator model. It is also possible to use both models to complement each other.

Profitability gap model

In this model, eligible projects are put out to tender competitively. Private companies can apply for the project by submitting a bid for the amount of funding required. This ensures that no excessive amounts of funding are paid out and that projects are awarded in a transparent and non-discriminatory manner. Ownership of the finished network lies with the company that wins the project.

Operator model

In the operator model, the network is not built by a private company – but rather by a municipality, an association of municipalities, or a municipal company. The projects are not put out to tender, but the expected expenditure and income need to be declared – and it is necessary to demonstrate a need for funding. In this case, the network owner is the municipality, the association of municipalities, or the municipal company.

However, the municipal owner does not operate on the end-customer market itself – but instead makes the network available to the telecommunications companies for a fee (wholesale-only). The owner can market the network itself (municipal operator model) or it can commission another network operator to operate and market the network (license model).

Comments: Init7’s stance on the high broadband strategy

In order to avoid a digital urban-rural divide, it is necessary for rural, economically unprofitable areas to be connected to the fiber optic network. Since network operators cannot be expected to invest in unprofitable areas, financial support is essential.

P2P network topology

Expansion using P2P network topology is the only acceptable network topology, as this is the only way to ensure technological innovation and fair competition between providers. Find out more in our blog post on P2P and P2MP and on our website.

It is encouraging that the Federal Council has ruled out P2MP (point-to-multipoint) network topology, even though it would have been around CHF 400 million cheaper according to calculations. The decisions made by COMCO, the Swiss Federal Administrative Court, and the Swiss Federal Supreme Court in the “fiber optic dispute” speak for themselves.

All competitors in the telecommunications industry can live quite well with the P2P 1-fiber model. In fact, FTTH infrastructure has been built almost everywhere according to the P2P 1- or 2-fiber optic principle. This concept also corresponds to the standards set out in the “Round Table on Fiber Optics”, which was adopted under the leadership of OFCOM over 10 years ago and enabled a unique standardization of FTTH expansion by all stakeholders. There is no reason to deviate from this standard in subsidized areas.

Financing

Financing via mobile communications licenses relies purely on hope. It is unclear how much revenue will be generated from the licenses. If revenues amount to less than the required CHF 1.4 billion, financing gaps will arise and expansion will be delayed. One shouldn’t sell the fur before shooting the bear.

Funding from the Federal Treasury seems to be the most sensible solution in our view. After all, the Federal Government has collected Swisscom dividends year after year since the telecom liberalization process in 1998.

All other proposals for financing are inadequate: The proposal for a “broadband tax” has been virtually wiped off the table by the Federal Council itself, and subsidiary funding by the cantons and municipalities does not appear to be the ultimate solution either, as this would leave the current patchwork approach of fiber optic coverage in place.

Funding model

In terms of regulatory policy, the operator model would be more correct than the profitability gap model. But it would also be a lot more complicated. Our experience shows that the cantonal and municipal energy supply companies sometimes have very individual ideas and requirements for their fiber optic network. Expansion is, therefore, often very cumbersome. This is why we consider the profitability gap model to be more sensible.

Moreover, in order to use the funding as efficiently as possible, we believe it would be most effective for Swisscom alone to receive the funding.

This is supported by the fact that Swisscom, together with its subsidiary Cablex, operates a well-oiled machine with know-how and experience that is capable of implementing 300,000 FTTH connections per year. Economies of scale could also be leveraged. Alternative providers benefit from the uniformity of accessibility and could very quickly create competing end-customer offers.

On the other hand, any individual funding project based on the operator model would require an extensive amount of planning and countless hours of coordination meetings – and all of this just to dig the first cable pipe ditch. Small individual networks are also complicated from the competitors’ point of view because renegotiations are always necessary. The effort involved is often not worthwhile for providers with a small market share. If Swisscom alone were to receive the CHF 1.4 billion in subsidies, this would, of course, be subject to certain conditions:

- Performance mandate: e.g., 99% of the population will have FTTH by 2033, 100% by 2037

- Uniform P2P network topology in the 1- or 2-fiber model without compromise

- Regulations: FTTH fiber optics would have to be regulated throughout Switzerland so that the telecoms competition desired by the legislature is fair for all providers

Regulations

Regulating telecommunications infrastructure would, of course, not only benefit the subsidized peripheral regions – but the entire economy. This aspect is missing from the Federal Government’s high broadband strategy, which is quite balanced overall.

The dilemma in which the Federal Council finds itself is becoming clear once again: On one hand, the Confederation’s expectations in terms of returns as the 51% majority shareholder of Swisscom need to be satisfied in the form of a reliably recurring, consistently high dividend; on the other hand, as legislator and regulator, it should also safeguard the interests of the Swiss population and economy by providing a public broadband service. There is still justified criticism that the telecoms liberalization measures adopted in 1998 were only half-hearted and, therefore, largely a failure, and this criticism is unlikely to die down any time soon. With the high broadband strategy now on the table, the Federal Council has the opportunity to correct at least some of the mistakes made during the telecoms liberalization process 25 years ago.